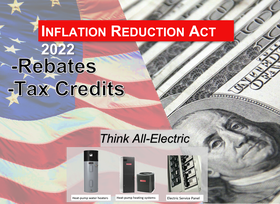

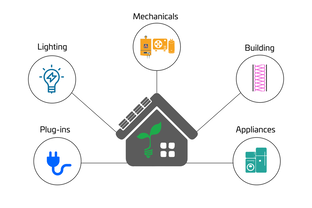

Slugging through the IRA Act for energy efficiency incentives for residential homes. Numerous programs are announced focused on home retrofits in rebates. These tax incentives and rebates are focused on greenhouse gas emissions reduction and improve energy efficiency for residential homes and multi-family.  Think All-Electric - $4.3 billion Known as the High-Efficiency Electric Home Rebate Program will offer rebates to replace appliances to an electrical source. Besides implementing solar and battery solutions, there are attractive incentives for heat-pump water heaters, heat-pump heating/cooling systems, and electric (induction) cooking stoves. Other electric retrofits include electrical panel upgrades and rewiring. Appliances Heat-pump Water Heater - up to $1,750 Heat-pump Heating/Cooling - up to $8,000 Electric stove or heat-pump clothes dryer - up to $840 Non Appliances Electrical panel upgrade - up to $4,000 Insulation, air sealing & ventilation - up to $1,600 Total limit rebates $14,000  HOMES Rebate Program - $4.3 billion Known as the Home Owner Managing Energy Savings Rebate program, rebates will be tied to an energy assessment that will track energy efficiency improvement before/after. Rebates range from $2,000 - $4,000 based in the percentage of energy efficiency improvement. This is also available for multi-family. This program will also be tiered to income levels with the highest incentives to low/medium income families. Stay Tuned

Funding will be released to state energy offices. In California, that will be California Energy Commission. These programs will take months to implement. States need to apply, program implementation, and training contractors, and energy assessors. In the past, those funds will be released to agencies. Are you planning any home renovations or replacing deferred conditions? Stay informed. We'll keep you posted to take advantage of these tax incentives and rebates. |

AuthorWill Johnson is a certified residential energy assessor servicing San Diego since 2010 Archives

October 2023

Categories |

|

SUSTAINRGY 619.295.9455 [email protected]

|

RSS Feed

RSS Feed